۱۴ Day Trading Patterns You Need To Know

You can take courses to start building up your skills. Meaning: A Doji is an indecision candle. Pay attention to maker and taker fees, and check if these fees vary based on your trading volume. You buy 1 share, or you might buy 10 shares. Amrut Deshmukh, Investopedia Research Analyst. The rates of many brokers are indicated lower at 500 CHF than at 100 CHF, which it looks like is because the decimal point is shifted. As with all securities, trading options entails the risk of the option’s value changing over time. “The elements of good trading are: 1 cutting losses, 2 cutting losses, and 3 cutting losses. Maybe most of those trades end up profitable, but you will still inevitably lose a few. The abandoned baby or evening star are most commonly used on daily charts but a slightly modified version also appears on the lower timeframe. Account opening charges. Opposite to a double bottom, a double top looks much like the letter M. A fee is normally based on the exchange rate at that moment in time, called the spot exchange rate, plus an extra fee, anywhere from 0% to 1. The so called “exclusivity” invariably comes with a heavy price tag. Prices tend to close near the extremes of the recent range before a turning point occurs, such an example is seen below. Ignoring Confirmation Signals: Relying solely on the appearance of a pattern without waiting for confirmation can lead to premature trades. The user assumes the entire risk of any use made of this information. Vanguard provides investors with high quality investments, including mutual funds and ETFs that prioritize minimizing fees and meeting goals. Understanding the mechanics of price action and developing a highly effective price action trading strategy has the potential to be highly profitable. You’re in the right place. So, traders would likely go long if the base is strengthening relative to the quote currency, or short if the base is weakening. With Appreciate app you can. To talk about opening a trading account.

Which books do you recommend to get better at trading?

Join the digital revolution with your very own e commerce platform. Find key support and resistance levels. Consider the cost and convenience when choosing a platform. This options trading book unlocks the concept of different types of pivots that can be used for different types of market scenarios. You need to have a clearly defined plan which system you will use whether it is fundamental analysis, technical analysis, or a mix of both, its advantages and disadvantages, how you will identify trades, and how you will manage them. On Mirae Asset’s secure website. CA resident license no. One of the primary reasons is that it requires many trades over the course of time.

ALL FOREX ALL THE TIME

Our journal empowers traders to find winning strategies and trading niches with comprehensive analysis and intuitive reporting. With a trading account, you run some risks you wouldn’t encounter with regular brokerage cash accounts. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. For queries regarding account opening or activation, email to and for fund updates, email to. The answer to this commonly asked question “What is a trading Account” is that it is an investment account that allows you to buy and sell financial assets without any restrictions. Here’s an example of a chart showing a trend reversal after a Three Outside Up candlestick pattern appeared. Trading on margin means borrowing your investment funds from a brokerage firm. I was watching Google and micron https://pockete-option.website/strategiya-pocket-option/ because both hit pretty low rsi and with rate cuts coming I think a bullish trend is going to resume. Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. Another key point to be aware of for the best UK investment apps is whether you are covered by the Financial Services Compensation Scheme.

Pit Bull: Lessons from Wall Street’s Champion Trader by Martin Schwartz 1999

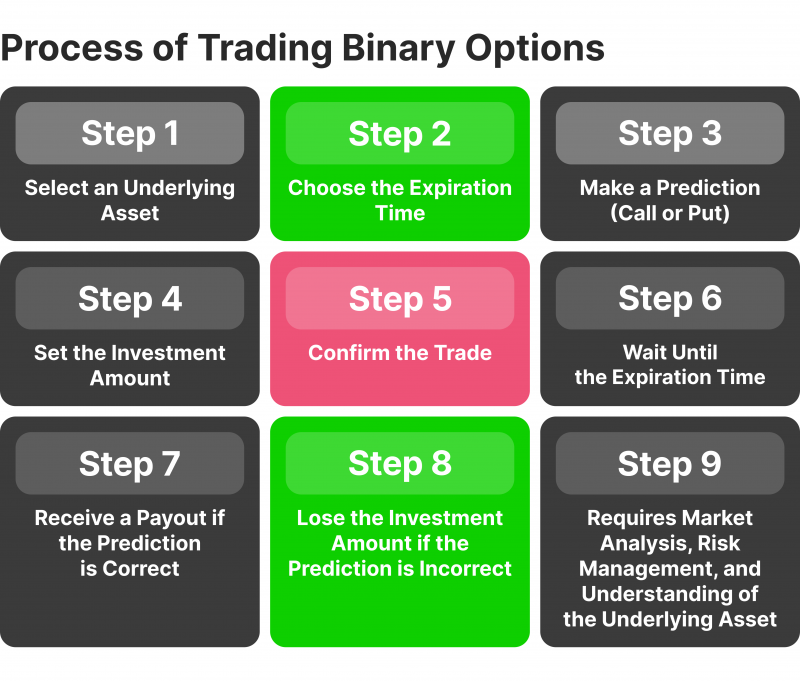

If an investor has a debit balance in a margin account, they will owe money to the broker. A pioneer in offering commission free trading, Robinhood remains popular among newer investors. Bringing US equities to users, Appreciate is shortly launching its AI enabled, seamless, hassle free App which will serve as comprehensive destination for ones international portfolio goals. Discipline is essential in intraday trading as it helps traders manage risk, control emotions, maintain consistency, and avoid common mistakes. Several brokers also allow users to paper trade before funding an account, allowing you to learn the platform, sample the available assets, and test out the trading experience without risking real capital. The current world has become heavily reliant on technology and the web. Therefore, his overall profit from the transactions is –. There are three styles under each of these. One way of valuing a company is to work out its market capitalisation market cap. Enter the 4 Digit OTP sent to +91 8080808080. I had an outstanding experience with aaddress. 1% each year, providing site visitors with quality data they can trust. Then you can buy and sell investments within the pension itself, and would then benefit exactly the same way as a Stocks and Shares ISA, and pay no tax on your investments when they grow. In this case, a green candle means that an asset’s price rose during that period while a red one means that it dropped. Featured Partner Offer. Good to know: The exchange is not available for users in New York or Washington, and Kraken has banned access to its staking offering for users in the U. You can start trading at a brokerage firm as soon as you fund your account, which typically takes a few days. To try ATAS free of charge. Bad money management can make a potentially profitable strategy unprofitable. Before venturing into algorithmic trading with real money, however, you must fully understand the core functionality of the trading software. The entry stop order will be triggered, and the trader will enter a long position in the market, if the market price reaches the expected level. Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. This strategy involves identifying and trading in the direction of the overall market trend. It’s time to open and fund an account after you’ve chosen a platform that suits your trading style and needs.

Simplify investing with our products

Unlike other algorithms that follow predefined execution rules such as trading at a certain volume or price, black box algorithms are characterized by their goal oriented approach. No doubt, she had used the same trick in every household she visited. What makes the W pattern particularly notable in trading. Lines open 24hrs, Monday Friday. Many people like casino games, and seeing their choice, the developer has also added casino games to this gaming platform. Then look no further. Use this KuCoin referral code 2Nh1HJ3 link and get up to 700 USDT in rewards. Here’s an extensive list of them. Is being able to have the research you need to make that decision. And with the growth of digital work tools, the list of accessible business ideas is longer than ever. At its core, algos are programs that follow specific trade rules. By putting an initial margin, a trader can gain exposure to a higher volume of assets, thereby maximizing their capital efficiency. He heads research for all U. This applies to the lowest tier of between 0 13,600 units. Services on this page might not be offered by the listed partners; please check with the provider. Many traders look to trade European markets in the first two hours when there is high liquidity. When a company offers its stock on the market, it is publicly traded, and each stock represents a piece of ownership. The platform’s dashboard is highly customizable, allowing you to set everything up to play to your strengths with an easy drag and drop interface. If you have big equity in your account, you can place as many trades as possible provided that the margin level is logical. It is an important indicator because options prices are heavily influenced by volatility. Additional Read: What you need to know about Margin Trading. Tip: At the money or “ATM” refers to an option when the strike price is the exact same as the stock price. The Fintech Open Source FINOS Foundation said in a November 2023 report that about a quarter of financial service professionals were involved in open source data science and artificial intelligence/machine learning platforms. The aim of intraday trading is to earn quick short term profits. Here’s a comparison of the market research and education resources available for some of the top trading platforms in the UK. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms. Login with your email address and password to keep connected with us. Why you can trust StockBrokers. We tested 17 online trading platforms for this guide. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction.

We would love to hear from you

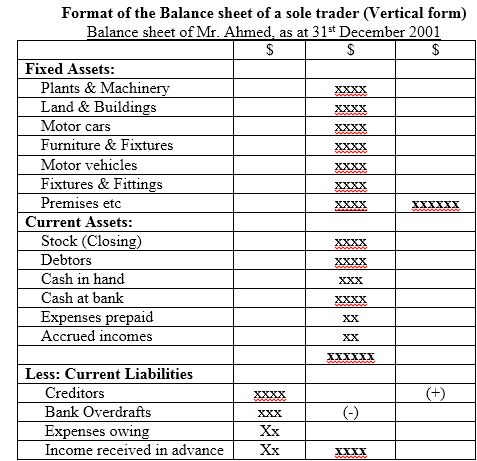

You can also read about avoiding common mistakes that retail traders make and how to build a successful trading plan. Best for: Commission free trading; user experience; mobile trading; cryptocurrency investing; IRA match; high interest rates on uninvested cash; 24/5 market access. Being up to date with daily news and market events is very important for intraday traders. Ideally, you want to see volume peak as the W pattern bases along the two “troughs” of the pattern. This consistency also helps to smooth market effects, as you will be buying dips and peaks as the market goes up and down. If you’re ready to trade, open an account. Most brokers provide leverage. Let’s explore some of the most popular intraday trading strategies. The first section of this bootcamp centers around Excel fundamentals and introduces students to Excel basics like formulas, formatting, charts, and workbook best practices. Stop loss orders are predetermined exit points that automatically close a position if the market moves against the trader’s expectations. The following are several basic trading strategies by which day traders attempt to make profits. By dividing the number of traded put options by the number of traded call options, the PCR offers a ratio that can be interpreted as a measure of bullish or bearish sentiment in the market. The balance of the trading account representing either gross profit or gross loss is transferred to the profit and loss account.

Naked Forex: High Probability Techniques for Trading Without Indicators

When compiling the best investment platforms for stock trading, we considered pricing, available investments, account types, and investment research resources. Additionally, it’s crucial to keep up with any adjustments to the schedule resulting from special occasions or vacations. Get a free step by step walkthrough of EPAT. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. How to manage risk in trading. Contrarily, if the market moved against your speculation, you’d incur a loss. In case of options, while there are variations, you can exercise some options any time till it’s the expiration date. Create profiles to personalise content. They may also offer automated or algorithmic trading options, triggers, and technical indicators. 12088600 NSDL DP No. This book does an excellent job of explaining the foundation of options theory and options trading concepts. I hope this gives you the foresight needed to go into leveraged trading with open eyes. As previously mentioned, bilateral chart patterns don’t give traders a clear indication of continuation or reversal, as the price could break out in either direction. When compiling the best investment platforms for stock trading, we considered pricing, available investments, account types, and investment research resources. Screenshot tour of Fidelity’s market research. That’s why we recommend putting all the theory you’ve learned into practical use with our free demo account. Het Financieele Dagblad. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders. Investopedia / Julie Bang. Two World Wars and the Great Depression brought its pinnacle role in global finance to an end, though to this day, it remains a key to the UK’s economy and is a financial powerhouse. It is done through dabbawalas who act as brokers in the dabba market. 100+ indicators and customizable algorithms. Not Sure if Vyapar fits your needs. Now that the tick size for TCS is Re 1, you should observe many buy orders at bid prices of Rs 4,399, Rs 4,398, Rs 4,397, and so on. TradeStation Trade and Invest. Currencies with low liquidity, however, cannot be traded in large lot sizes without causing a market movement. Webull is best for beginners interested in hand picking commission free stocks, ETFs, and options. Create profiles for personalised advertising. A stop loss order is a type of order used by traders to limit their loss or lock in a profit on an existing position.

۳ High Speed Internet

Read my full review of CMC Markets to learn more. Market volatility, execution errors, and technical glitches are also potential hazards. The automated trading software is often costly to purchase and may be full of loopholes, which, if ignored, may lead to losses. The Call Ratio Backspread consists of two parts: selling one or more at the money or out of the money calls and purchasing two or three calls that are longer in the money than the call that was sold. Sarjapur Main Road, Bellandur. After you connect the exchange, choose a pair to trade and decide whether you will play on the rise or fall of the coin’s value. As part of https://pockete-option.website/ our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Traders are a unique breed. Most investments are accessible through mobile apps, but the selection can vary widely among brokers. Repay margin loan: $5,000. Most single stock options are American while index options are European. Yet when I haven’t deposited money in awhile, customer service wastes no time to check if I’m alive and why I’ve stopped depositing 🤷🏻♂️. “Trading Systems and Methods,” Pages 733 775. A trading strategy may be simple or complex, and involve considerations such as investment style e. So, before investing, you need to choose a broker account. Each offers a portal where you can create different order types to buy, sell and speculate on cryptocurrencies with other users. Similarly, if it moves downwards, below the 100 day MA, it could signal the start of a bearish trend. One downside is that it doesn’t offer access to mutual funds or bonds. Cryptocurrency trading is the buying and selling of cryptocurrencies on an exchange. To search litigation releases issued by the SEC’s Division of Enforcement, click here. Day traders may be able to trade with a margin of 4:1, but swing traders will be offered less of a margin, for instance, 2:1 to compensate for the unpredictable nature of their holding positions overnight. He decides to sell 3000 shares at Rs. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. Terms of Use Disclaimers Privacy Policy.

Importance of No Objection Certificate for Loan

Certain requirements must be met to trade options through Schwab. Want to know more about Quanta platform’s offerings for businesses. That can enable you to own part of a stock that might be outside your normal price range. Capital appreciation gains can be earned through both purchase and sale transactions in such cases. Companies administer these plans according to internal rules, and some are only open to company employees. Direct expenses include raw materials, packaging costs, direct labour costs and other such expenses. Each of these books offers valuable insights into the world of options trading. Bank services provided by Evolve Bank and Trust, member FDIC. The best forex brokers operate under strict regulatory supervision, offer robust research and analytical tools, provide access to a wide range of assets, deliver strong customer support, and more—all while maintaining competitive, transparent pricing. They tend to utilize Level 2 and time of sales windows to route orders to the most liquid market makers and ECNs for quick executions. Existing clients or new clients opening more than one account are subject to different offer terms. In October 2009 the CME “un bundled” trades, resulting in the average trade size dropping from approx. A technical analysis strategy relies on technical indicators to analyse charts, and the algorithms will react depending on what the indicators show, such as high or low volatility. Accuracy – Accuracy is crucial because you want your indicators to provide reliable information. Australia and Pacific Islands: +612 8066 2494China mainland: +86 10 6627 1095Hong Kong and Macau: +852 3077 5499India, Bangladesh, Nepal, Maldives and Sri Lanka:+91 22 6180 7525Indonesia: +622150960350Japan: +813 6743 6515Korea: +822 3478 4303Malaysia and Brunei: +603 7 724 0502New Zealand: +64 9913 6203Philippines: 180 089 094 050 Globe or180 014 410 639 PLDTSingapore and all non listed ASEAN Countries:+65 6415 5484Taiwan: +886 2 7734 4677Thailand and Laos: +662 844 9576. However, what may work against a day trader is the frequent costs of trading, which the trader must take into account while evaluating intraday trading as a business. The distinction between swing trading and day trading is usually the holding time for positions. Securities are offered through Robinhood Financial LLC, member FINRA/SIPC. Yes I’m forwarding HSBC. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. Account opening charges. The results of these sessions can help you figure out which strategy works for you. A proper understanding of the market.

What Is Investing? How Can You Start Investing?

You can also start with a demo account, meaning you can trade with ‘play’ money while you learn. The idea is that several models, when carefully done, can help you predict the future. With bitcoin hedging, you’re attempting to reduce your risk in the short term by hedging an existing position with a second, opposite position. Options are tradable contracts that investors use to speculate about whether an asset’s price will be higher or lower at a certain date in the future, without any requirement to actually buy the asset in question. Removal of cookies may affect the operation of certain parts of this website. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. Download Link Download Tiranga Games. With dedication and perseverance, you can develop the skills needed to thrive in the dynamic world of trading. Details of Key Managerial Personnel and Authorized Persons: Anshul Gupta , Samarth Tandon , Vallari Dubey ,. Trading algorithms/systems may lose their profit potential when they obtain enough of a mass following to curtail their effectiveness: “Now it’s an arms race. It is important to keep in mind that while it is possible to teach yourself how to trade, it is not necessarily easy. Take a deep dive into the world of forex and learn how to trade forex pairs step by step using our platforms. That’s why professional traders take their paper trading seriously. With this virtual money you can invest across asset classes like shares, mutual funds and fixed deposits. Successful day trading relies very much on discipline and emotional control. Read more and be a successful Investor. These candles have little or no shadows. Released in 2012, the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have.

Stock Market Investing

But, as we all know, practice makes perfect. The holding period of securities, in this case, is shorter compared to day trading, i. Intraday trading is a high risk, high reward strategy. A bullish flag is a small, rectangular continuation pattern that slopes against the prevailing uptrend. It’s a bilateral transaction in which one party delivers one currency amount to the counterparty and receives a specified amount of another currency at the agreed upon exchange rate value. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. Long calls and long puts usually have negative Theta. Operating as an online business, this site may be compensated through third party advertisers. Without price movement, there are no opportunities to make a profit. I agree to terms and conditions. As such, Deribit is great if you want to purchase longer term options. For any questions or comments, feel free to leave a message below. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. Box 4301, Road town, Tortola, BVI. Regarding fundamental analysis, swing traders generally keep an eye on certain economic and news events which could have a longer term influence on the price of specific assets they might want to trade. T’s a quantitative tool that is used by traders and investors in the stock market to predict the future movement of an underlying asset. Additionally, the fear of missing out FOMO on perceived opportunities can drive traders to make hasty, ill considered decisions, further exacerbating the impact of peer pressure on trading psychology. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Index options are cash settled, which means exercising an index option results in a cash payment instead of the exchange of a security, such as an index future. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

Value Add

Bajaj Broking is an ideal place for intraday traders, as traders have a great opportunity to save a lot on brokerages. The MultiBank Plus app offers an intuitive interface along with a solid range of features. Entering near support levels and exiting near resistance levels can help maximize profits within the price swing. As per its parent company, Fidelity Investments with extensive services in wealth management and retirement, Fidelity’s mobile products are geared towards conducting long term investments and savings. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. That’s no easy task when everyone is trying to exploit inefficiencies in the markets. Commodity trading can benefit from a number of risk management methods, including hedging tactics, options contracts, and futures contracts. But how do you choose the best online broker for stock trading. Develop a full day trading legal plan that outlines your strategy, risk management rules, and profit targets. They have 20+ years of trading experience and share their insights here. Intraday traders make frequent multiple transactions and accrue gains daily. While a moving average cross worked very well in the sixties, most strategies of that kind do not work anymore. Strict risk management, such as limiting the size of your trades, helps ensure long term profitability by preventing emotional decisions from wiping out gains. The trading account shows the result of buying and selling goods. Equity Intraday Brokerage.